Forecasting the 2023 Market Outlook

While the Federal Reserve might have our backs in the case of an economic or financial collapse, right now they have one goal in mind: fight inflation. And until they reach that goal, the world’s stock markets will just have to wait and watch for further signs of weakening inflation. The outlook consensus for equities in 2023 seems to be a weak first half followed by better times in the second half. In the meantime, the credit markets will likely attract investor attention during the first half of 2023. With U.S. government notes and bonds yielding 4%, public corporate credits yielding 5-8% and private market credits offering 8%+ yields, there are now several asset classes to put a smile on a retiree’s face. As investors we should all be mindful that the lower credit quality, higher yielding fixed income does come with more reward and potentially more risk.

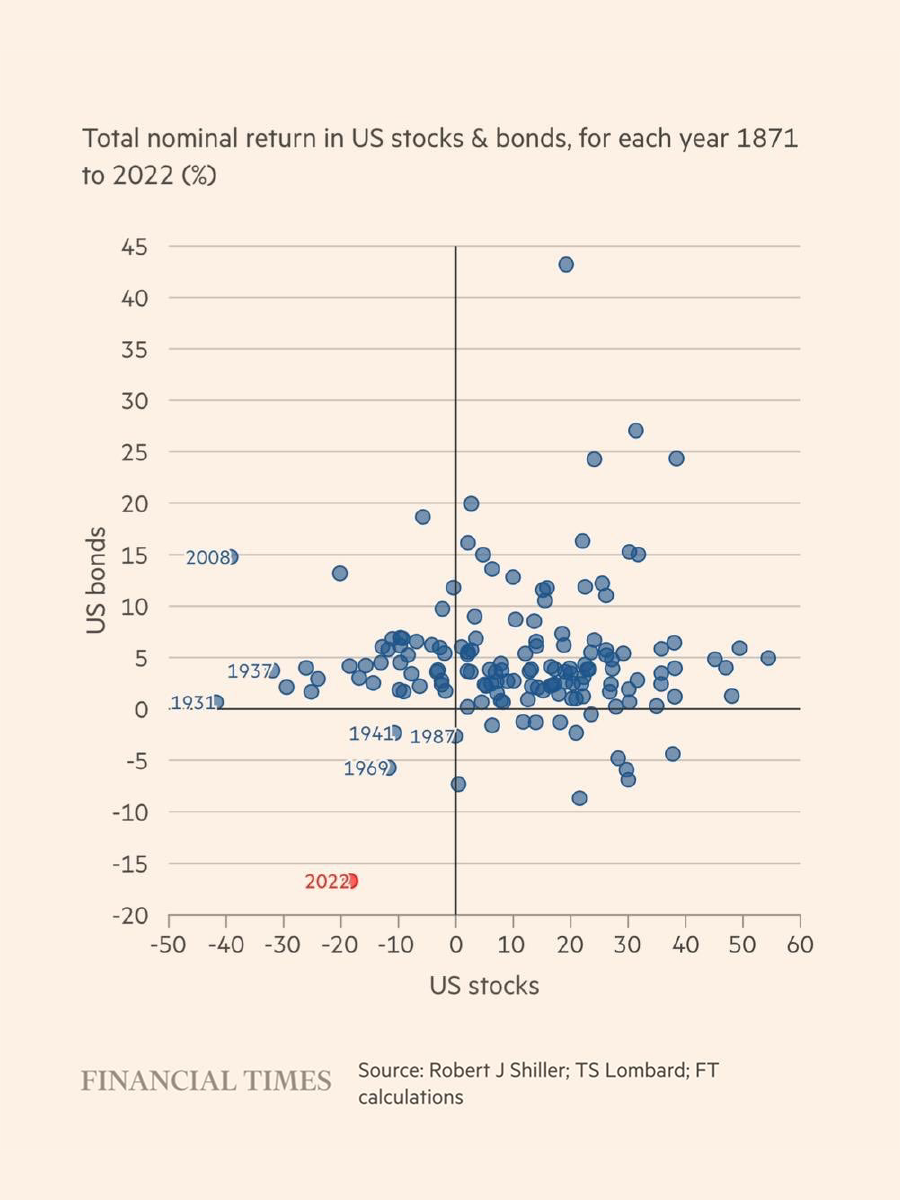

So, bonds now, equities later? That outlook would make for a much easier investing year than 2022, when both declined.

While the U.S. stock market may wait a few more inflation readings before it resumes it’s historical long-term upward trajectory, there are always some interesting investable assets to research and consider:

If U.S. interest rates continue to fall on a relative basis versus other countries, the U.S. dollar should continue to feel pressure in 2023, which would open an entire world of non-US dollar investments up for consideration. This could be rewarding given the much lower valuations.

China is reopening after a zero-Covid policy. Its economy may get better, and the country may shift from 2nd gear right into 5th. China is about 1/3 to 1/5 of most EM indexes. Imagine China re-opening after being in lock-down for three years.

There is no short-term fix for the current oil supply situation. A sustained period of underinvestment, waning production growth, and the added impact of the Russian/Ukraine war could set up a period of long-term energy outperformance. Limited capacity and a new-found capital discipline may lead to strong margins.

The world has very low inventories of copper. Copper is in a higher structural demand state due to the rise of electric vehicles and the greening of the grid (think solar, wind and all that transmission).

The U.S. and Europe are reshoring now and into the future. Great news for the industrials, builders, and supply chain availability. However, probably not good for some future corporate operating margins as semiconductors in Arizona and Texas will be more expensive than the same product made in China.

As U.S. inflation trends lower, the U.S. yield curve may steepen. We expect lots of big plays here including the plunging short term Treasury yields.

Focused, equally weighted, diversified portfolios will provide investors with the best chance for success as we move into 2023.

The investment climate has changed and will require a new perspective on capital allocations. Stay true to your individual risk tolerance and asset allocation. Focused, equally weighted, diversified portfolios will provide investors with the best chance for success as we move into 2023. This stage of the economic cycle will require more emphasis on security selection versus relying on passive index investing.

Although 2023 could be a challenging year, our team is prepared for the challenge.

Share this article:

Author

Bill RomansRelated posts

December 2022 Market Update

The Federal Open Market Committee (FOMC) announced a seventh consecutive rate in

Recap: Major General (Ret.) James A. “Spider” Marks

https://www.youtube.com/watch?v=DUBWkw-kxUISUMMARY Major General (Ret.) James A.

Navigating 2024

As we close out 2023 and move into 2024, this is the time of the year where many