Patterns May Expose Opportunities

The Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) have joined forces to guarantee to cover all deposits of Silicon Valley Bank as well as Signature Bank of New York. They have also created a new short-term lending facility called the Bank Term Funding Program or BTFP. The BTFP will offer loans with maturities of up to a year to banks, savings associations, credit unions and other eligible depository institutions.

“The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress,” the Fed said in a statement Sunday.

A key element of the program is acceptable loan collateral- including U.S. Treasuries and mortgage-backed securities. These securities will be valued at “par”, regardless of their present mark-to-market price. This is important because it will allow the banks to fund potential deposit outflows without being forced to sell and realize significant losses.

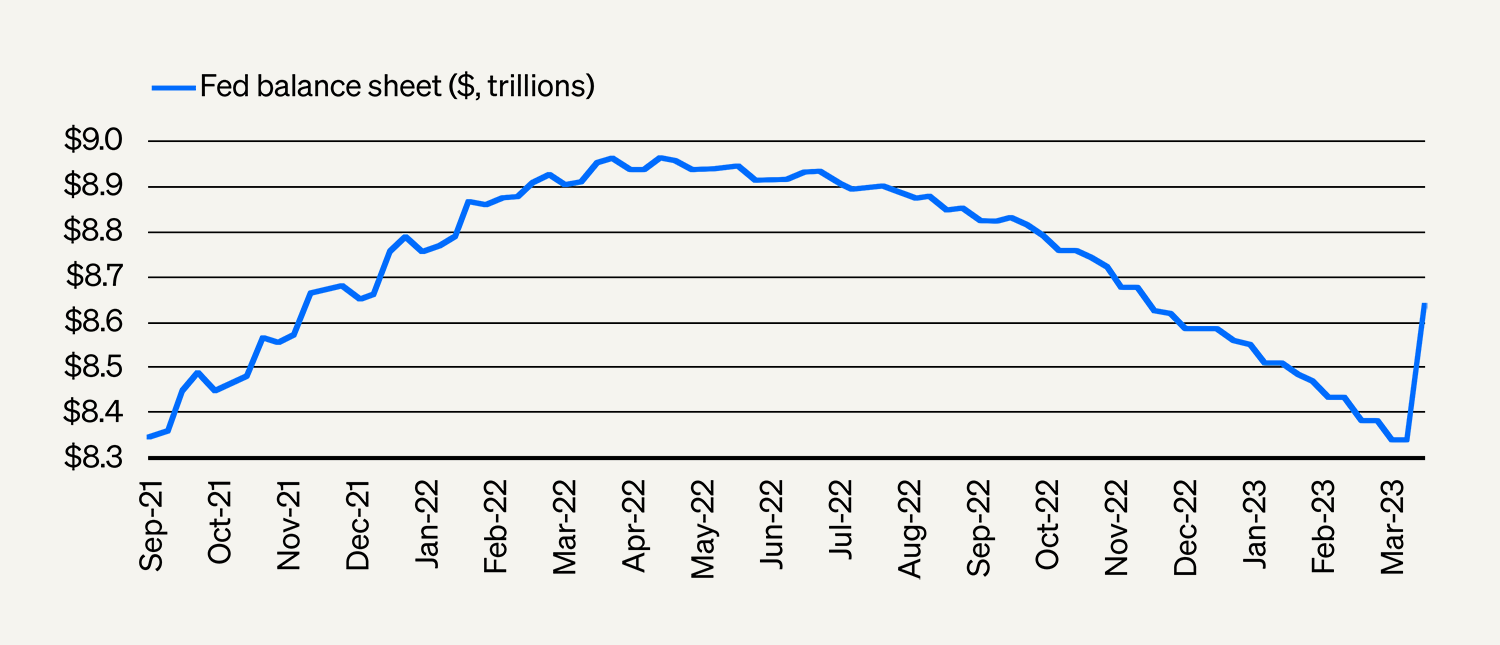

Several institutions have taken advantage of this program which has caused the Fed’s balance sheet to balloon again (see chart below). In one week, more than one quarter of the Fed’s quantitative tightening has been reversed. In the past, a liquidity boost has coincided with a boost in asset prices. In March 2008, a similar situation happened when Bear Sterns was rescued by JP Morgan. The three months following that event, regional banks, represented by the Regional Bank Index(KRE) declined and the Nasdaq 100- QQQ ( Largest 100 non-financial companies) outperformed.

Source: Bloomberg, as of 3/15/2023

In our opinion, this is why the market has rallied so hard the last few days. History does not always repeat itself, but this is a pattern that we will be watching in the near-term. This short-term view does not change our defensive long-term view at this point.

BRM Investment Management (“Massey Romans Capital”) is an investment adviser registered under the Investment Advisers Act of 1940. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, the Firm cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of the Firm and may not actually come to pass.Author

Paul MasseyRelated posts

What Past Election Results Can Tell Us About The Markets

As we try to provide our clients with as much knowledge and insight as possible,

Forecasting the 2023 Market Outlook

While the Federal Reserve might have our backs in the case of an economic or fin

Why Do Investors Care So Much About the Federal Reserve?

The Federal Reserve (Fed) is essential because they manage the supply or availab