What Past Election Results Can Tell Us About The Markets

As we try to provide our clients with as much knowledge and insight as possible, the number one question we’ve been asked in recent months is “How will the 2024 Election impact my investments?”

This has been supported by a recent Janus Henderson Investment Survey…

“1,000 mass affluent and high-net-worth investors were surveyed to understand their mindset amid a challenging geopolitical climate and an unsettled market and economic environment.”

“The number one concern today is the Election. The number three theme is Investors are hungry for knowledge.“

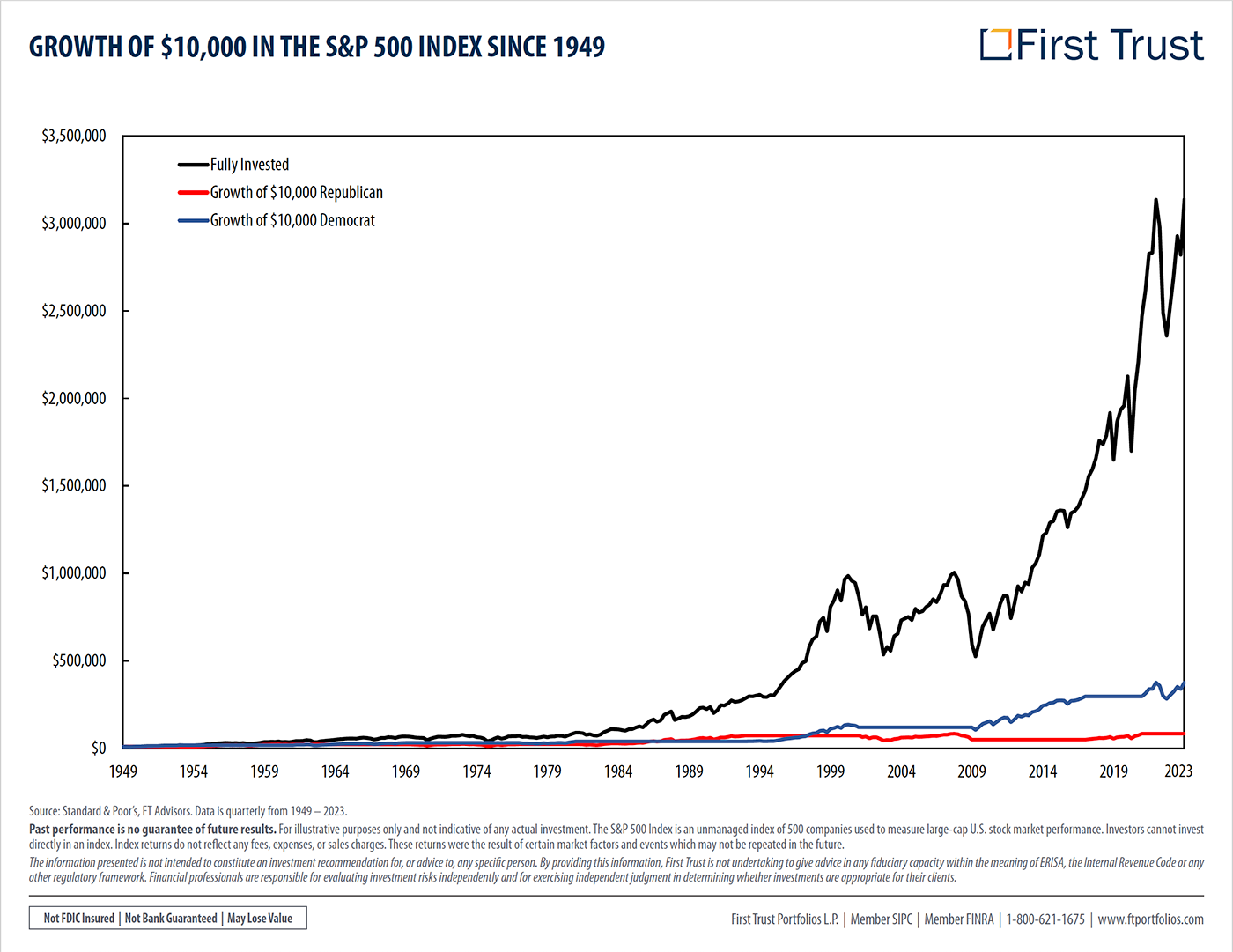

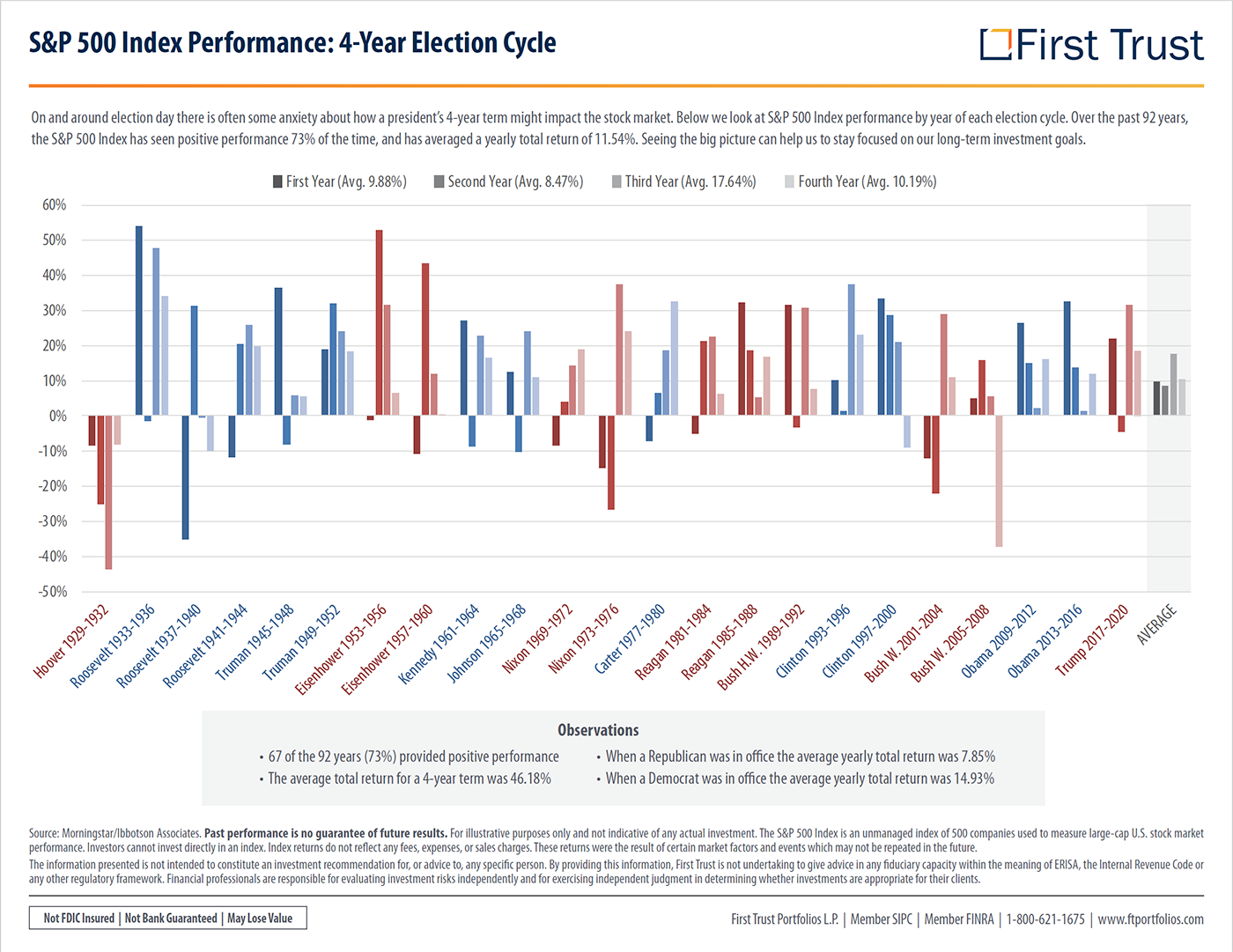

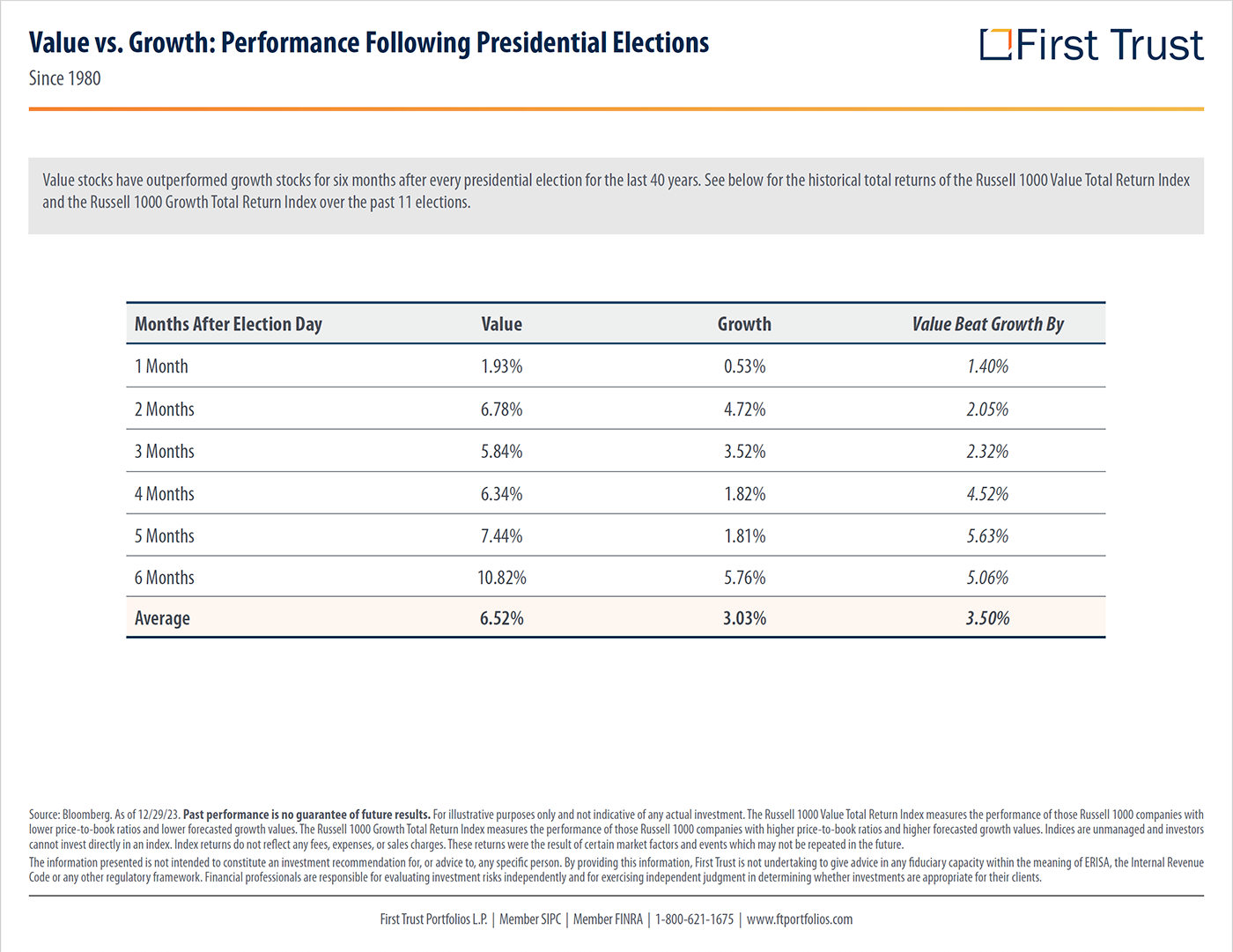

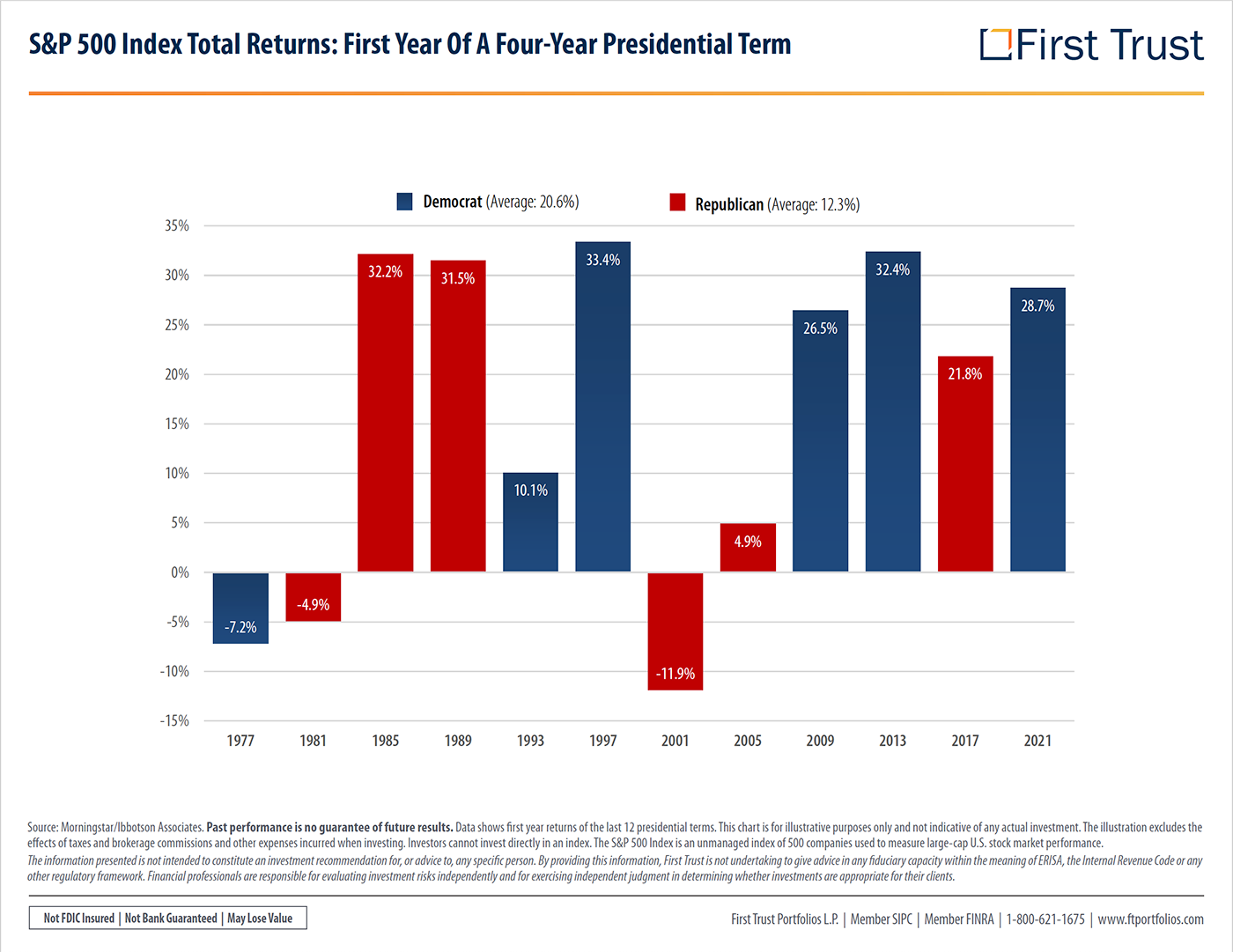

While we can’t provide you with an ironclad blueprint as it relates to the upcoming election, one of our research affiliates, First Trust, created a report detailing past elections in relation to the markets. This is NOT a political endorsement and yes this time may be different. However, we thought it was interesting, so we wanted to share it with you. Based on the last 75 years, the best course of action was staying invested.

The S&P 500 is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

BRM Investment Management (“Massey Romans Capital”) is an investment adviser registered under the Investment Advisers Act of 1940. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, the Firm cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of the Firm and may not actually come to pass.Author

Bill RomansRelated posts

Headwinds and Tailwinds

The seasonality of the markets has not disappointed us so far as investors in 20

Navigating 2024

As we close out 2023 and move into 2024, this is the time of the year where many

December 2022 Market Update

The Federal Open Market Committee (FOMC) announced a seventh consecutive rate in