Productivity Miracle

The US Stock Market, as represented by the S&P500, is trading near an all-time high. How can this be the case when economist are warning us of a potential hard landing accompanied with a Recession, Global Market Instability, Federal Reserve and Interest Rates, Inflation Fears, Geopolitical Tensions, and Investor Sentiment that sent the fear index(VIX) last Monday to levels not seen since the Covid pandemic. Why is the market near this historic level?

Our research has led us to study the US Labor Productivity Growth Rate.

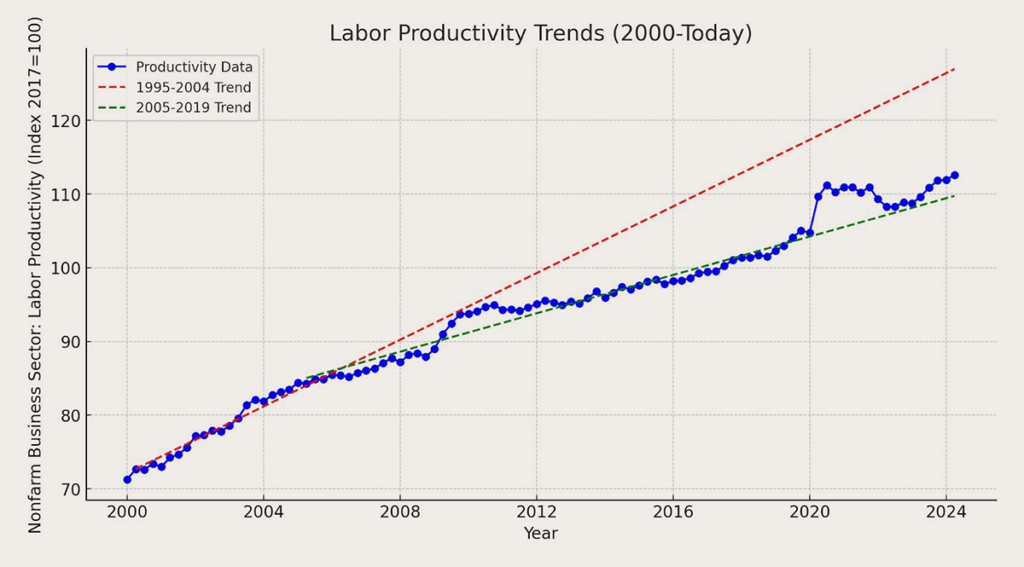

Labor productivity in the United States has been a key driver of economic growth and living standards over the past several decades. This analysis examines trends in US labor productivity from the 1970s to present day, exploring its relationship with wages, stock market performance, and economic sectors. Recent data indicates a potential resurgence in productivity growth, driven by technological advancements, changes in work arrangements, and renewed business dynamism. As the US economy continues to evolve, understanding and enhancing labor productivity remains crucial for long-term prosperity and global competitiveness.The overall 50-year average productivity growth rate was approximately 1.8% per year.

However, the U.S. experienced a significant acceleration in labor productivity growth between 1995 and 2004. During this period, labor productivity in the nonfarm business sector increased at an annual rate of approximately 2.9%. This marked a substantial improvement compared to the previous decades, where the growth rate was about 1.5% annually from 1973 to 1995 and 2004 to 2022. This surge in productivity was driven by several factors, including rapid technological advancements, particularly in information technology (IT), and strong output growth across various sectors. The period saw industries that produced or heavily used IT products leading the productivity gains, reflecting the impact of technological innovation on economic performance. Overall, the late 1990s were characterized by robust productivity growth, which contributed to economic expansion and improved efficiency in the U.S. economy. Stock market performance has generally shown a positive correlation with productivity growth, with periods of high productivity often coinciding with strong market returns. This was exemplified during the “productivity miracle” of 1995-2004, when labor productivity grew at 2.9% annually and the S&P 500 tripled in value.

Recall our piece on Artificial Intelligence | Massey Romans Capital dated April 4, 2004.

If the productivity resurgence began in 2023, could 2024 be1996?

Well, from a calendar perspective, both years started on a Monday, both years are leap years, both years were presidential election years and Summer Olympic years. Other than that, it’s important to note the geopolitical and economic landscapes of 1996 and 2024 differ significantly.- Technological Advancements

- Economic Growth

- Interest Rates

- Business Dynamism

- Labor Market

- Inflation

While there are similarities in productivity trends and technological advancements, the current economic landscape faces unique challenges, including the aftermath of a global pandemic, supply chain disruptions, and ongoing geopolitical tensions. The potential for a productivity boom like 1995 exists, but it’s contingent on factors such as the widespread adoption of new technologies, continued business dynamism, and favorable policy environments.

It is our opinion that the increase in Productivity is causing earnings to rise, and higher earnings are what ultimately drive stock prices higher. This is a component we will be focusing on as we allocate portfolios.The S&P 500 is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Formidable Asset Management (“Massey Romans Capital”) is an investment adviser registered under the Investment Advisers Act of 1940. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, the Firm cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of the Firm and may not actually come to pass.Author

Paul MasseyRelated posts

How Markets Typically Respond During the Last 3 Months of a Presidential Election

The final stretch of a U.S. presidential election is a period marked by heighten

Recap: Major General (Ret.) James A. “Spider” Marks

https://www.youtube.com/watch?v=DUBWkw-kxUISUMMARY Major General (Ret.) James A.

Headwinds and Tailwinds

The seasonality of the markets has not disappointed us so far as investors in 20